Preliminary Proxy Statement Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) Soliciting Material Pursuant to No fee required. Fee computed on table below per Exchange Act Rules14a-6(i)(1) and0-11. Fee paid previously with preliminary materials. Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

UNITED STATES (Amendment No. )☐ ☐ ☐ Definitive Proxy Statement ☐ Definitive Additional Materials ☒ Definitive Proxy Statement☐Definitive Additional Materials☐§240.14a-12☒ ☐ amount on which the filing fee is calculated and state how it was determined): ☐ ☐ EXPLANATORY NOTEBothhave securities that have been registered under(together, the Securities Act“Companies”) by a joint venture of 1933, as amended, which are publicly tradedBlackstone Real Estate Partners and listed onStarwood Capital Group. In connection with the NASDAQ Global Select Market as paired shares. Each paired share consists of one share of common stock of Extended Stay America, Inc. that is attached to and trades as a single unitproposed transaction, the Companies will file with one share of Class B common stock of ESH Hospitality, Inc. Accordingly, the Proxy Statements of Extended Stay America, Inc., and its controlled subsidiary, ESH Hospitality, Inc., are each included in this filing on Schedule 14A. Each registrant hereto is filing on its own behalf all of the information contained in this filing that relates to such registrant. Each registrant hereto is not filing any information that does not relate to such registrant, and therefore makes no representation as to any such information.

annual meeting

EXTENDED STAY AMERICA, INC.

11525 N. Community House Road, Suite 100

Charlotte, North Carolina 28277

(980)345-1600

www.aboutstay.com

Notice Of Annual Meeting Of Shareholders

To Be Held On May 28, 2020

Extended Stay America, Inc will hold its 2020 Annual Meeting of Shareholders (the “Annual Meeting”) on Thursday, May 28, 2020 at 8:00 a.m. (Eastern Daylight Time). Due to public health concerns and to assist in safeguarding the health and well-being of our shareholders and employees during theCOVID-19 outbreak, the Annual Meeting will be a ‘virtual’ meeting, held as a live webcast via the Internet. By attending the Annual Meeting virtually, shareholders will be afforded the same rights and opportunities to participate that they would have at anin-person meeting. Shareholders will be able to attend the Annual Meeting, listen, vote, and submit questions by visiting www.virtualshareholdermeeting.com/stay2020 and signing in with a16-digit control number included in these proxy materials. We expect to resume in person shareholder meetings in the future.

The Annual Meeting will be convened for the following purposes:

|

|

|

|

|

Shareholders of record at the close of business on April 8, 2020 are entitled to receive notice of and to vote at the Annual Meeting and any adjournment or postponement thereof.

This Notice and the enclosed Proxy Statement and Proxy Card are first being made available to shareholders on or about April 23, 2020.

By Order of the Board of Directors,

Christopher N. Dekle

General Counsel and Corporate Secretary

Charlotte, North Carolina

April 23, 2020

|

summary

We are furnishing this Proxy Statement to you as part of a solicitation by the Board of Directors (the “Board”) of Extended Stay America, Inc., a Delaware corporation, of proxies to be voted at our 2020 Annual Meeting of Shareholders and at any reconvened meeting after an adjournment or postponement of the meeting (the “Annual Meeting”). Unless the context otherwise requires, all references in this Proxy Statement to the “Corporation,” “Extended Stay America,” “Extended Stay,” “we,” “us,” and “our” refer to Extended Stay America, Inc. and its subsidiaries, excluding ESH Hospitality, Inc. (“ESH REIT”). All references in this Proxy Statement to the “Company” refer to the Corporation, ESH REIT and their subsidiaries considered as a single enterprise. Each share of Corporation common stock, par value $0.01 per share, is attached to and trades as a single unit with a share of Class B common stock of ESH REIT, par value $0.01 per share, (each, a “Paired Share”).

Our telephone number is (980)345-1600, and our mailing address is 11525 N. Community House Road, Suite 100, Charlotte, North Carolina 28277. Our website is located at www.esa.com. The inclusion of our website address here and elsewhere in this Proxy Statement does not include or incorporate by reference the information on our website into this Proxy Statement. The information contained on, or that can be accessed through, our website is not a part of this Proxy Statement.

IMPORTANT INFORMATION REGARDING THE AVAILABILITY OF PROXY MATERIALS

As permitted by the rules of the Securities and Exchange Commission (“SEC”), we have elected and furnish to send you this full set oftheir stockholders a joint proxy materials, includingstatement, accompanying WHITE PROXY CARD and other relevant documents. STOCKHOLDERS OF THE COMPANIES ARE ADVISED TO READ THE JOINT PROXY STATEMENT WHEN IT BECOMES AVAILABLE (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION. Investors may obtain a proxy card, and additionally to notify youfree copy of the availability of thesejoint proxy materials onstatement (when it becomes available) and other relevant documents filed by the Internet.Companies with the SEC at the SEC’s Web site at http://www.sec.gov. The Notice of Meeting, Proxy Statement, Proxy Cardjoint proxy statement, accompanying WHITE PROXY CARD and 2019 Annual Report, which includes our combined annual report on Form10-Ksuch other documents once filed with the SEC may also be obtained for free from the year ended December 31, 2019, are available free of charge on the investor relationsInvestor Relations section of our website (www.aboutstay.com)the Companies’ web site (https://www.aboutstay.com/investor-relations) or at www.proxyvote.com.

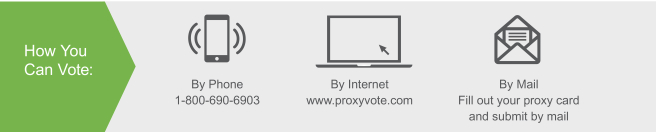

YOUR VOTE IS VERY IMPORTANT. PLEASE CAREFULLY READ THE ATTACHED PROXY STATEMENT. EVEN IF YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE PROMPTLY COMPLETE, EXECUTE, DATE AND RETURN THE ENCLOSED PROXY CARD IN THE ACCOMPANYING POSTAGE-PAID ENVELOPE. NO POSTAGE IS NECESSARY IF MAILED IN THE UNITED STATES. YOU MAY ALSO VOTE ELECTRONICALLY VIA THE INTERNET OR BY TELEPHONE BY FOLLOWING THE INSTRUCTIONS ON THE PROXY CARD. IF YOU VOTE BY INTERNET OR TELEPHONE, YOU DO NOT NEED TO RETURN A WRITTEN PROXY CARD BY MAIL. YOU MAY REVOKE YOUR PROXY AND VOTE IN PERSON IF YOU ATTEND THE ANNUAL MEETING.

PLEASE NOTE THAT THE ANNUAL MEETING WILL BE A ‘VIRTUAL’ MEETING, HELD AS A LIVE WEBCAST VIA THE INTERNET. DETAILS ON HOW TO ATTEND AND VOTE AT THE VIRTUAL MEETING MAY BE FOUND IN THE SECTION OF THIS PROXY TITLED ‘FREQUENTLY ASKED QUESTIONS.’ A SHAREHOLDER THAT JOINS THE VIRTUAL MEETING BY SIGNING INTO, AND COMPLYING WITH THE REQUIREMENTS OF, THE LIVE WEBCAST, WILL BE ATTENDING THE ANNUAL MEETING ‘IN PERSON.’

|  |

|

ANNUAL MEETING OF SHAREHOLDERS

MAY 28, 2020, 8:00 A.M. (EASTERN DAYLIGHT TIME)

Due to theCOVID-19 outbreak, this year’s meeting will be held virtually via live webcast at www.virtualshareholdermeeting.com/stay2020.

PURPOSES:

|  |  |  |  |

| ||||

|

|

| ||

|

|

| ||

|

|

| ||

|

|

| ||

|

| ||||||

| ||||||

|

| |||||

| ||||||

|

|

|

|  |

|

|

| |||

| ||||

|

|

|  |

|

Withby directing a passion to support a charitable cause so closerequest to the heartsCompanies at ir@esa.com. Copies of its employees, in 2013 Extended Stay America partnereddocuments filed by the Companies with the American Cancer Society to createSEC may also be obtained for free at the Hotel Keys Of Hope® program, which provides free and deeply discounted hotel stays for cancer patientsSEC’s Web site at http://www.sec.gov.

SHAREHOLDER OUTREACH AND ENGAGEMENT HIGHLIGHTS

We recognize the value of actively engaging with our shareholders so we can better understand their viewsrespective officers and interests and share our perspective. In 2019, our senior management and investor relations team participated in over 300 investor meetings or calls, with more than 400 investor touchpoints. We review this outreach and the shareholder input we receive with our Board.

We also workeddirectors may be deemed to maintain our visibilitybe participants in the investment community by participating in:

|

|  |

|

|

|

|  |

election of directors

|

Our Board has nominated seven people for election as directors atproxies from the Annual Meeting. Each nominee is currently a directorstockholders of the Corporation. If elected, each nominee will hold office untilCompanies in connection with the next annual meeting of shareholders, or until his or her successor has been duly electedproposed transaction. Information about the Companies’ executive officers and qualified, subject to a director’s earlier death, resignation or removal. Each nominee has consented to be named in this Proxy Statement and has agreed to serve if elected. If a nominee is unable to serve or for good cause will not serve if elected, the persons named as proxies may vote for a substitute nominee recommended by the Board and, unless you indicate otherwise on the proxy card, your shares will be voted in favor of the Board’s remaining nominees.

We believe each nominee meets the qualifications that have been established for service on our Board. As demonstrated in the following biographies, we believe that the nominees have professional experience in areas that are highly relevant to our strategy and operations, and bring skills and other attributes that make them outstanding candidates to serve on our Board.

|

The following table summarizes information about our nominees as of April 8, 2020. Detailed biographies of each nominee follow.

Name | Age | Director Since | Audit Committee | Compensation Committee |

Nominating and | Independent? | ||||||||||||||||||||||||

Bruce N. HaasePresident and Chief Executive Officer | 59 | 2019 | ||||||||||||||||||||||||||||

Douglas G. Geoga | 64 | 2013 | ✓ | |||||||||||||||||||||||||||

Kapila K. Anand | 66 | 2016 | Chair | ✓ | ||||||||||||||||||||||||||

Ellen Keszler | 57 | 2018 | Member* | Member | ✓ | |||||||||||||||||||||||||

Jodie W. McLean | 51 | 2017 | Member* | Member | ✓ | |||||||||||||||||||||||||

Thomas F. O’TooleDirector | 61 | 2017 | Member | Chair | ✓ | |||||||||||||||||||||||||

Richard F. WallmanDirector | 69 | 2013 | Chair* | Member | ✓ | |||||||||||||||||||||||||

|

Mr. Haase, Mr. Geoga, and Ms. Anand also sit on the Board of Directors of ESH REIT. Under our Corporate Governance Guidelines (as defined below), service on our Board and the Board of ESH REIT constitute a single directorship for purposes of overboarding calculations.

|  |

Our Board has affirmatively determined that each of our directors other than Mr. Haase is independent under the rules of the SEC and the NASDAQ Global Select Market (“NASDAQ”). Detailed information regarding each nominee as of April 8, 2020 is set forth below:

|

|

Presidentin their Annual Report on Form 10-K, which was filed by each of ESA and ESH REIT since November 2019with the SEC on February 25, 2021, and as director of ESH REIT since April 2018. From 2014 to 2016, Mr. Haase was the Chief Executive Officer of WoodSpring Hotels, LLC, a leading economy extended stay lodging brand. Mr. Haase ledjoint proxy statement for the design, launch and franchising2020 annual meetings of the WoodSpring Suites brand, including the conversion of properties from the company’s Value Place brand. Mr. Haase previously served in a series of executive positions with Choice Hotels International, Inc. including Executive Vice President, Global Brands, Marketing & Operations (from 2008 to 2012), Senior Vice President, Domestic Brand Operations & International Division (from 2007 to 2008), Senior Vice President, International Division (from 2000 to 2007), and Vice President, Finance & Treasurer (in 2000). Prior to joining Choice, Mr. Haase held a series of positions with The Ryland Group, Inc., Caterair International Corporation, Marriott Corporation, and Goldman, Sachs, & Company.

Mr. Haase brings valuable extended stay lodging, operations, strategic planning, franchise and brand development experience to our Board. As the only executivestockholders of the Corporation to serve on the Board, Mr. Haase also contributes a level of understanding of the Corporation not easily attainable by an outside director.

|

|

|

Mr. Geoga has served as Chair of the Board of the Corporation since July 2013 and as Chair of the Board of Directors of ESH REIT since November 2013. Mr. Geoga served as anon-voting member and theNon-Executive Chair of our predecessor entities, ESH Hospitality Holdings LLC (“Holdings”) and ESH Strategies Holdings LLC (“Strategies Holdings”), from October 2010 to November 2013. Mr. Geoga is President and Chief Executive Officer of Salt Creek Hospitality, LLC, a privately-held firm engaged in making investments in the hospitality industry and providing related advisory services. Mr. Geoga also serves as a consultant to Atlantica Investment Holdings Limited, which through affiliated companies is the second largest manager of hotels in Brazil. Since 2002, Mr. Geoga has served, and from November 2002 to December 2009, Mr. Geoga’s primary occupation was serving, as principal of Geoga Group, LLC, an investment and advisory consulting firm focused primarily on the hospitality industry. Until July 2006, Mr. Geoga’s primary occupation was serving as the President of Global Hyatt Corporation and as the President of Hyatt Corporation and the President of AIC Holding Co., the parent corporation of Hyatt International Corporation, then both privately-held subsidiaries of Global Hyatt Corporation which collectively operated the Hyatt chain of hotels throughout the world. In addition, from 2000 through 2005, Mr. Geoga served as President of Hospitality Investment Fund, LLC, a privately-held firmCompanies, which was engaged in making investments in lodging and hospitality companies and projects.

Mr. Geoga’s history as President of Hyatt Corporation, a global leader in its industry, as well as his extensive experience in private business investment, brings to the Board the perspective of both an operating executive and one who is sophisticated in corporate investments and finance.

|  |

|

|

Past directorships:KPMG LLP—Americas; KPMG LLP—U.S.; Franciscan Ministries; KPMG Foundation (Chair); Chicago Network (Chair)

Skills and expertise:Lodging; real estate; REITs; accounting; finance, risk management; corporate governance; internal controls over financial reporting

Ms. Anand has served as a director of the Corporation since July 2016 and as a director of ESH REIT since May 2017. Ms. Anand served as an audit partner and later an advisory partner at KPMG LLP from 1989 until her retirement in March 2016. Ms. Anand joined KPMG LLP in 1979 and served in a variety of roles in addition to her role as a partner, including the NationalPartner-in-Charge, Public Policy Business Initiatives (from 2008 to 2013) and segment leader for the Travel, Leisure, and Hospitality industry and member of the Global Real Estate Steering Committee (each from 2013 to 2016).

Ms. Anand’s extensive experience serving a diverse group of real estate, gaming, private equity and hospitality clients on numerous audit and advisory projects, including strategic planning, construction and development risk assessments, enterprise risk management, internal controls and corporate governance, brings to the Board a significant understanding of the financial, lodging, real estate and corporate governance issues and risks that affect the Corporation.

|

|

|

Skills and expertise:Distribution; technology; revenue management; travel and tourism; finance

Ms. Keszler has served as a director of the Corporation since February 2018. Ms. Keszler has served as the President and Chief Executive Officer of Clear Sky Associates, a management and strategy consulting firm focused on the technology and travel industries, since 2008. Previously, Ms. Keszler served as President of Travelocity Business from 2003 to 2007. From 2000 to 2003, Ms. Keszler served as Senior Vice President—North American Division of Sabre Travel Network. From 1987 to 2000, Ms. Keszler held various finance roles at Sabre Holdings, American Airlines and JCPenney. These functions included financial planning, strategic analysis, treasury, mergers and acquisitions, and financial operations. Additionally, she serves as an advisor to numerous travel technology startup companies.

Ms. Keszler’s extensive experience in technology, revenue management, customer engagement, and finance brings to the Board a significant understanding of issues and risks that affect the Corporation.

|

|

Ms. McLean has served as a director of the Corporation since June 2017. Ms. McLean has served as the Chief Executive Officer of EDENS, a private commercial real estate company that develops, owns, and operates retail community shopping centers in primary markets across the country, since 2015. She joined EDENS in 1990 and has held various positions including Chief Investment Officer from 1997 to 2015 and also President from 2002 to 2015.

Ms. McLean’s extensive experience in consumer retail trends, customer engagement, real estate and investments brings to the Board a significant understanding of issues and risks that affect the Corporation.

|  |

|

|

Skills and expertise: Lodging business; travel industry; revenue strategy, marketing; distribution; customer data analytics; customer loyalty; branding; information systems

Mr. O’Toole has served as a director of the Corporation since May 2017. Since September 2018 he has held the positions of Executive Director of the Program for Data Analytics and Clinical Professor of Marketing at the Kellogg School of Management of Northwestern University. He held the position of Senior Fellow and Clinical Professor of Marketing at Kellogg from November 2016 to September 2018. He has also served as a Senior Advisor to McKinsey & Company since January 2017.

Mr. O’Toole served as Chief Marketing Officer and Senior Vice President of United Airlines from January 2015 to December 2016, and President of MileagePlus Holdings, LLC from April 2012 to December 2016, of United Continental Airlines, Inc., a global air carrier. Mr. O’Toole joined United Airlines in 2010, serving as Senior Vice President, Marketing and Loyalty from 2012 to 2015, Chief Operating Officer of Mileage Plus Holdings, LLC from 2010 to 2012 and Chief Marketing Officer in 2010. At United Airlines, he was responsible for brand development, marketing, ancillary revenue, ecommerce, digital channels, loyalty,co-brand credit cards, customer data analytics and related functions. Prior to that, he served as an advisor with Diamond Management & Technology Consultants, a management and technology consulting firm, from 2009 to 2010. Mr. O’Toole served in various positions of increasing responsibility at Hyatt Hotels Corporation from 1995 to 2008, including as Chief Marketing Officer and Chief Information Officer from 2006 to 2008.

Mr. O’Toole’s extensive travel industry, hospitality and marketing experience inC-level positions brings to the Board a broad and deep understanding of the commercial, operational and strategic imperatives of running a large scale corporation in the travel industry and hospitality category.

|

|

|

Skills and expertise:Corporate finance and accounting; corporate governance; internal controls over financial reporting

Mr. Wallman has served as a director of the Corporation since July 2013 and as a director of ESH REIT from November 2013 to May 2016. He previously served as anon-voting member of the board of managers of Holdings and Strategies Holdings from May 2012 to November 2013. Mr. Wallman served as the Chief Financial Officer and Senior Vice President of Honeywell International Inc., a provider of diversified industrial technology and manufacturing products, and its predecessor AlliedSignal, from March 1995 until his retirement in July 2003. Mr. Wallman has also served in senior financial positions with IBM and Chrysler Corporation.

Mr. Wallman’s extensive financial background brings to the Board a significant understanding of the financial issues and risks that affect the Corporation. Mr. Wallman also serves on the boards of other diverse publicly held companies, which gives him a multi-industry perspective and exposure to developments and issues that impact the management and operations of a large scale corporation.

*Mr. Wallman has notified us that he intends to step down from the Wright Medical Group board upon completion of its sale, which is expected to occur in 2020.

|  |

CORPORATE GOVERNANCE AND BOARD MATTERS

We believe that good corporate governance helps to ensure that the Corporation is managed for the long-term benefit of our shareholders. We regularly review and consider our corporate governance policies and practices, the SEC’s corporate governance rules and regulations, and the corporate governance listing standards of NASDAQ, the stock exchange on which our Paired Shares are traded.

The Board directs and oversees the management of the business and affairs of the Corporation in a manner consistentfiled with the bestSEC on April 23, 2020. Investors may obtain more detailed information regarding the direct and indirect interests of the Corporationrespective executive officers and its shareholders. In this oversight role, the Board serves as the ultimate decision-making bodydirectors of the Corporation, except for those matters reservedCompanies in the acquisition by reading the Current Reports on Form 8-K to or sharedbe filed by the Companies on March 16, 2021 and the preliminary and definitive joint proxy statement regarding the proposed transaction when they are filed with the Corporation’s shareholders.

WeSEC. When available, stockholders may obtain free copies of these documents as described in the preceding paragraph.

|

|

|

|

|

|

|

The Corporate Governance Guidelines further provide that the Board, acting through the Nominating and Corporate Governance Committee (as described below), conduct a self-evaluation at least annually to determine whether it and its committees are functioning effectively. In addition, the Corporate Governance Guidelines provide that each committee conduct a self-evaluation and compare its performance to the requirements of its charter.

The Corporate Governance Guidelines are posted on the investor relations section of our website at www.aboutstay.com. The Corporate Governance Guidelines are reviewed by the Nominating and Corporate Governance Committee at least annually to ensure that they effectively promote the best interests of both the Corporation and the Corporation’s shareholders and that they comply with all applicable laws, regulations and NASDAQ requirements.

To further align the interests of our independent directors and our shareholders, the Board has adopted stock ownership guidelines under which independent directors, after an initialphase-in period, will generally be required to maintain vested equity holdings with a value at least equal to three times annual cash compensation.

|

Prohibition on Speculative Securities Transactions

Our Securities Trading and Disclosure Policy prohibits directors and executive officers from engaging in the following with respect to the Corporation’s securities:

|

|

|

|

Code of Business Conduct and Ethics

We have adopted the Extended Stay America, Inc. Code of Business Conduct and Ethics (the “Code of Business Conduct and Ethics”) that applies to all of our directors, officers and employees, including our principal executive officer (our President and CEO), principal financial officer (our CFO), principal accounting officer (our CFO) and persons performing similar functions. A copy of the Code of Business Conduct and Ethics is posted on the investor relations section of our website at www.aboutstay.com. If we amend or waive provisions of the Code of Business Conduct and Ethics with respect to such officers, we intend to disclose the amendment or waiver on our website.

Board of Directors and Director Independence

The Board consists of seven directors, all of whom have been nominated forre-election at the Annual Meeting. Our Second Amended and Restated Bylaws provide that directors are elected at the annual meeting of shareholders and each director is elected to serve until his or her successor is duly elected or until his or her earlier death, resignation or removal.

The Corporate Governance Guidelines define an “independent” director in accordance with the NASDAQ corporate governance rules for listed companies and require the Board to review and make an affirmative determination as to the independence of each director at least annually. The NASDAQ independence definition includes a series of objective tests, such as that the director is not an employee of the Corporation and has not engaged in various types of business dealings with the Corporation or certain other related party transactions with the Corporation. Because it is not possible to anticipate or explicitly provide for all potential conflicts of interest that may affect independence, the Board is also responsible for determining affirmatively, as to each independent director, that no material relationships exist that, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In making these determinations, the Board broadly considers all relevant facts and circumstances, including information provided by the directors and the Corporation with regard to each director’s business and personal activities as they may relate to the Corporation and the Corporation’s management. The Board may delegate independence determinations to the Nominating and Corporate Governance Committee to the extent permitted by NASDAQ.

|  |

Our Board has affirmatively determined that each of our directors other than Mr. Haase is independent under the guidelines for director independence set forth in the Corporate Governance Guidelines and under all applicable rules of the SEC and NASDAQ.

We do not have a policy as to whether the role of the Board Chair and the Chief Executive Officer should be separate or combined. The Board may select its Chair and Chief Executive Officer in any way it considers to be in the best interests of the Corporation. At this time, in particular given the transition in our CEO position in 2019, we believe it is beneficial to separate the Chair and Chief Executive Officer in order to enhance the Chair’s oversight capability. Mr. Haase serves as our Chief Executive Officer and Mr. Geoga serves as Board Chair. The Board believes this leadership structure, which separates the Chair and Chief Executive Officer roles, is appropriate corporate governance for us at this time. In particular, the Board believes that this leadership structure clarifies the individual roles and responsibilities of Mr. Haase and Mr. Geoga and enhances accountability. The Board recognizes that there is no single, generally accepted approach to providing Board leadership and that the Board’s leadership structure may vary in the future as circumstances warrant. If the Board determines that it is in the best interests of our shareholders to combine the positions of Chair and Chief Executive Officer, the independent directors will designate a Lead Independent Director.

Board Oversight of Risk Management

The Board oversees, and provides direction with respect to, management’sday-to-day risk management activities and processes. While the full Board is responsible for risk oversight, the Board uses its committees, as appropriate, to monitor and address the risks that are within the scope of a particular committee’s expertise or charter. The Board and applicable committees periodically receive management reports on our business operations, financial results and strategic plans.

The Board delegates appropriate aspects of its oversight responsibility to the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. The Audit Committee assists the Board in fulfilling its risk oversight responsibilities by periodically reviewing, among other things, our financial statements, our internal audit, accounting and financial functions and reporting processes, including our systems of internal controls for financial reporting, our compliance with legal and regulatory requirements, our enterprise risk management framework, and our cybersecurity risk framework. In particular, the Audit Committee periodically reviews and discusses with management the internal audit function and the independent auditor, as applicable, our major financial risk exposure and the guidelines and policies that management has established with respect to risk assessment and risk management. The Compensation Committee assists the Board with oversight of risks associated with our compensation policies and practices. The Nominating and Corporate Governance Committee assists the Board with oversight of risks associated with our governance. In each case, the Board or the applicable committee oversees the steps that management has taken to monitor and control such exposures. As part of the Committees’ reviews, our directors ask questions, offer insights and challenge management to continually improve its risk assessment and management. The Board has full access to management, as well as the ability to engage advisors in order to assist in its risk oversight role.

|

The Chief Executive Officer’s membership on and collaboration with the Board allows him to gauge whether management is providing adequate information for the Board to understand the interrelationships of our various business and financial risks. He is available to the Board to address any questions regarding executive management’s ability to identify and mitigate risks and weigh them against potential rewards.

The Nominating and Corporate Governance Committee is responsible for identifying individuals believed to be qualified to become directors and selecting, or recommending to the Board for its selection, the director nominees for the next annual meeting of shareholders or to fill vacancies or newly created directorships that may occur between such meetings, including reviewing and making recommendations to the Board whether members of the Board should stand forre-election. The Board then nominates candidates each year for election orre-election by shareholders or appoints new Board members to fill vacancies. In identifying prospective director candidates, the Nominating and Corporate Governance Committee may seek referrals from other members of the Board, management and third-party sources. The Nominating and Corporate Governance Committee may, but is not required to, retain a search firm in order to assist it in identifying candidates to serve as directors of the Board. The Nominating and Corporate Governance Committee retained Spencer Stuart to assist with the transition of our CEO and President in 2019 and to assist with certain candidate searches into 2020. The Nominating and Corporate Governance Committee screens all potential candidates in the same manner regardless of the source of the recommendation.

The Nominating and Corporate Governance Committee does not maintain a fixed set of qualifications for director nominees other than the minimum individual qualifications described below. In considering candidates for the Board, the Nominating and Corporate Governance Committee considers all factors it deems appropriate, which may include (a) ensuring that the Board, as a whole, is appropriately diverse and consists of individuals with various and relevant career experience, relevant technical skills, relevant business or government acumen, industry knowledge and experience, financial expertise (including expertise that could qualify a director as an “audit committee financial expert” as that term is defined by SEC rules), and (b) minimum individual qualifications, including strength of character, mature judgment, familiarity with the Corporation’s business and industry, independence of thought and an ability to work collegially. The Nominating and Corporate Governance Committee also may consider the current size, composition and combined expertise of the Board and the extent to which a candidate would fill a present need on the Board. In particular, the Nominating and Corporate Governance Committee may consider the requirements that the members of the Board as a group maintain the requisite qualifications under the applicable NASDAQ listing standards for independence for the Board as a whole and for appointing individuals to the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. Although the Nominating and Corporate Governance Committee considers diversity of background and experiences, neither the Corporate Governance Guidelines nor the Nominating and Corporate Governance Committee Charter include a formal diversity policy.

The Board monitors the mix of specific experience, qualifications and skills of its directors in order to assure that the Board, as a whole, has the necessary tools to perform its oversight function effectively in light of the Corporation’s business and structure.

|  |

The Nominating and Corporate Governance Committee will consider candidates suggested by shareholders and will evaluate such candidates on a basis substantially similar to that which it uses to evaluate other nominees. Any shareholder who wishes to recommend a director candidate for consideration by the Nominating and Corporate Governance Committee may do so by submitting a recommendation in writing to the Chair of the Nominating and Corporate Governance Committee. See “Communications with the Board” below for how to communicate with the Chair of the Nominating and Corporate Governance Committee. Recommendations should include any information the shareholder believes would be helpful to the Nominating and Corporate Governance Committee in evaluating the candidate and must include information that would be required to be disclosed in a proxy statement soliciting proxies for the election of such candidate, including such candidate’s written consent to being named in the proxy statement as a nominee and to serving as director if elected. If the Nominating and Corporate Governance Committee determines to nominate a shareholder-recommended candidate and recommends his or her election, then his or her name will be included on the proxy card for our next annual meeting in accordance with the procedures set forth in our Second Amended and Restated Bylaws. Shareholders may also directly nominate directors for election at the Corporation’s annual shareholders meeting by following the provisions set forth in our Second Amended and Restated Bylaws, whose qualifications the Nominating and Corporate Governance Committee will consider. See “Frequently Asked Questions—What is the deadline under our Second Amended and Restated Bylaws for shareholders to nominate persons for election to the Board or to propose other matters to be considered at our 2021 annual meeting of shareholders?” for additional information.

Proxy Access Director Nominations

In addition to advance notice procedures, our Second Amended and Restated Bylaws also include provisions permitting, subject to certain specified terms and conditions, shareholders who have maintained continuous qualifying ownership of at least 3% of outstanding common stock for at least three years to nominate a number of director candidates not to exceed the greater of two candidates or 20% of the number of directors then in office who will be included in our annual meeting proxy statement. Eligible shareholders who wish to nominate a proxy access candidate must follow the procedures described in our Second Amended and Restated Bylaws. Proxy access candidates and the shareholder nominators meeting the qualifications and requirements set forth in our Second Amended and Restated Bylaws will be included in the Corporation’s proxy statement and ballot. To be timely, an eligible shareholder’s proxy access notice must be mailed to our General Counsel and Corporate Secretary at 11525 N. Community House Road, Suite 100, Charlotte, North Carolina 28277, no earlier than 150 days and no later than 120 days before theone-year anniversary of the date that we commenced mailing of our definitive proxy statement (as stated in such proxy statement) for the immediately preceding annual meeting, except as otherwise provided in our Second Amended and Restated Bylaws.

Meetings of the Board and Committees

During 2019, the Board held four regular meetings and four telephonic special meetings, in addition to taking various actions by unanimous written consent. During 2019, each incumbent director attended at least 75% of the total meetings of the Board held during the period in which he or she was a director and the total number of meetings held by all of the committees of the Board on which he or she served during the period of his or her service on the committee. Directors are expected to attend all Board meetings and all meetings of the committee or committees of the Board of which they are a member. Attendance by

|

telephone or videoconference is deemed attendance at a meeting. Additionally, all director nominees are encouraged to attend the annual shareholders meeting. All of the directors who were then serving on the Board attended the 2019 annual shareholders meeting.

Pursuant to our Corporate Governance Guidelines, our Board currently plans to hold at least four meetings each year, with additional meetings to occur (or action to be taken by unanimous written consent) at the discretion of the Board.

Executive Sessions ofNon-Management Directors

Pursuant to our Corporate Governance Guidelines, in order to ensure free and open discussion and communication among thenon-management directors of the Board, thenon-management directors meet in executive session at most Board meetings with no members of management present. Mr. Geoga serves as the Chair of executive sessions. Independent directors meet in an executive session that excludes management and affiliated directors, if any, at least once per year.

Any interested parties wishing to communicate with, or otherwise make his or her concerns known directly to the Board or Chair of any of the Audit, Compensation and Nominating and Corporate Governance Committees, or to the independent directors, may do so by addressing such communications or concerns to the General Counsel and Corporate Secretary of the Corporation, 11525 N. Community House Road, Suite 100, Charlotte, North Carolina 28277. The General Counsel and Corporate Secretary or Chair will forward such communications to the appropriate party as soon as practicable. Such communications may be done confidentiallyunable to obtain required stockholder approvals or anonymously.

Committees ofthat other conditions to closing the Board

The Board has an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. Each committee is composed solely of independent directors. Each committee operates under its own written charter approved by the Board, copies of which are available on the investor relations section of our website at www.aboutstay.com.

The following table shows the current membership of each committee of our Board and the number of meetings held by each committee during 2019:

Director

| Audit Committee

| Compensation

|

Nominating and

| |||

Kapila K. Anand

|

| Chair

|

| |||

Ellen Keszler

| Member

|

| Member

| |||

Jodie W. McLean

| Member

| Member

|

| |||

Thomas F. O’Toole

|

| Member

| Chair

| |||

Richard F. Wallman

| Chair

|

| Member

| |||

Number of 2019 Meetings†

| 8

| 4

| 4

| |||

|

|  |

The Audit Committee currently consists of Ms. Keszler, Ms. McLean, and Mr. Wallman. Mr. Wallman is the Chair of the Audit Committee. The Board has determined that each Audit Committee member qualifies as an “audit committee financial expert” as defined in Item 407(d)(5) of RegulationS-K and as “independent” as defined in Rule10A-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and the NASDAQ listing standards.

The principal duties and responsibilities of the Audit Committee are set forth in its written charter, and include, among other things, to oversee and monitor:

|

|

|

|

|

|

The Audit Committee also reviews and approves certain related party transactions, as described under “Certain Relationships and Related Party Transactions—Related Party Transaction Policy.” Additional information about the responsibilities of the Audit Committee and its activities during 2019 are also described in the Audit Committee Report contained in this Proxy Statement.

The Compensation Committee currently consists of Ms. Anand, Ms. McLean, and Mr. O’Toole. Ms. Anand is the Chair of the Compensation Committee. The Board has determined that each Compensation Committee member is “independent” as defined by the NASDAQ listing standards.

The principal duties and responsibilities of the Compensation Committee are set forth in its written charter, and include, among other things:

|

|

|

|

|

|

|

|

The Compensation Committee has the authority to and does engage the services of independent advisors, experts and others to assist it from time to time. In accordance with this authority, the Compensation Committee has engaged Pearl Meyer & Partners, LLC (“Pearl Meyer”) as its independent compensation consultant, as described under “Executive Compensation—Compensation Discussion and Analysis—Our Decision Making Process.”

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee currently consists of Ms. Keszler, Mr. O’Toole, and Mr. Wallman. Mr. O’Toole is the Chair of the Nominating and Corporate Governance Committee. The Board has determined that each Nominating and Corporate Governance Committee member is “independent” as defined by the NASDAQ listing standards.

The principal duties and responsibilities of the Nominating and Corporate Governance Committee are set forth in its written charter, and include, among other things:

|

|

|

|

|

|

Compensation Committee Interlocks and Insider Participation

None of the members of our Compensation Committee has at any time been one of our executive officers or employees. During 2019, none of our executive officers served as a member of the board of directors or compensation committee of an entity that has an executive officer serving as a member of the Compensation Committee, and none of our executive officers served as a member of the compensation committee of an entity that has an executive officer serving as a director on the Board.

|  |

At the Board’s regular meeting in May 2019, the Compensation Committee affirmed the existing director compensation program that provides the following:

Except as provided below, each independent director receives an annual cash retainer of $90,000 and an annual equity retainer with a value at grant of $100,000. Equity retainers are granted in restricted stock units that vest one year from the day of the grant.

The Chairs of the Board and of each Committee receive an additional cash retainer in the following amounts:

| ||||

|

| |||

|

| |||

|

| |||

|

| |||

The Board Chair doesproposed mergers may not receive any additional cash retainer to the extent he or she serves as a Committee Chair.

Mr. Haase, Mr. Geoga and Ms. Anand also serve on the Board of Directors of ESH REIT. Although the Boards of Directors of the Corporation and ESH REIT represent different interests, there is substantial overlap in the materials upon which the members of each Board of Directors rely in preparing for meetings and otherwise serving as directors. Recognizing that the incremental work required to serve on the second board is less than twice the effort of serving on a single board, Mr. Geoga and Ms. Anand each receive a total annual cash retainer of $120,000 and an annual equity retainer with a value at grant of $150,000 for their service on both Boards, the cost of which is split evenly between the Corporation and ESH REIT. The compensation paid to Ms. Anand and Mr. Geoga for serving as Committee or Board Chairs is not affected. Mr. Haase does not receive compensation for serving on the Board of Directors of the Corporation and ESH REIT.

The Compensation Committee previously adopted an amendment to the director compensation program permitting each director to receive the value of his or her cash retainers in Paired Shares.

|

The table below sets forth the portion of the compensation paid to the members of the Board that is attributable to services performed during the fiscal year ended December 31, 2019.

Director | Fees earned or paid in cash | Stock Awards(1) | All Other Compensation(2) | Total | ||||||||||||

Douglas G. Geoga | $ | — | $ | 73,177 | (3) | $ | 85,000 | $ | 158,177 | |||||||

Kapila K. Anand | $ | 70,000 | $ | 73,177 | (4) | $ | — | $ | 143,177 | |||||||

Ellen Keszler | $ | 90,000 | $ | 97,564 | (5) | $ | — | $ | 187,564 | |||||||

Jodie W. McLean | $ | — | $ | 97,564 | (6) | $ | 90,000 | $ | 187,564 | |||||||

Thomas F. O’Toole | $ | — | $ | 97,564 | (7) | $ | 97,500 | $ | 195,064 | |||||||

Richard F. Wallman | $ | 78,750 | $ | 97,564 | (8) | $ | 26,250 | $ | 202,564 | |||||||

Jonathan S. Halkyard(9) | $ | — | $ | — | $ | — | $ | — | ||||||||

Bruce N. Haase(10) | $ | — | $ | — | $ | — | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|

As a result of theCOVID-19 pandemic and its related impact on the Company’s business operations, on April 3, 2020, the members of the Board of Directors of the Corporation agreed to a twenty percent (20%) reduction of their cash-based fees for the second quarter of 2020.

|  |

say-on-pay

|

|

Section 14A of the Exchange Act requires the Corporation to request shareholder approval, on an advisory basis, of the compensation paid to our named executive officers (“NEOs”) as disclosed pursuant to the SEC’s compensation disclosure rules. This proposal is commonly known as a“say-on-pay” proposal.

As part of the Compensation Committee’s efforts to ensure that the interests of our NEOs are aligned with those of our shareholders, the Compensation Committee considers the results of the Corporation’s prior shareholder advisory votes on executive compensation. Our most recentsay-on-pay vote was held in 2019 and yielded an approval by 96.68% of the votes cast. The Committee considers these results to reflect substantial shareholder support of the Corporation’s executive compensation program, and has continued to consider shareholder feedback when reviewing, designing and implementing our executive compensation program.

The Compensation Discussion and Analysis (“CD&A”) beginning on page 22 of this Proxy Statement sets forth detailed information about our executive compensation program.

Our executive compensation program is designed to (i) attract, engage and retain a high quality workforce that helps achieve immediate and longer term success and (ii) motivate and inspire associate behavior that fosters a high performing culture and is focused on delivering business objectives. We believe that our executive compensation program accomplishes these objectives while remaining strongly aligned with the long-term interests of our shareholders.

As an advisory vote, this proposal is not binding upon the Corporation. However, our Compensation Committee will continue to use shareholder feedback, both as expressed by yoursay-on-pay vote and as provided directly to us, as an important consideration in making future NEO compensation decisions.

The Board therefore recommends that shareholders vote in favor of the following resolution:

RESOLVED, that the shareholders of the Corporation approve, on an advisory basis, the compensation of the Corporation’s named executive officers for fiscal 2019, as disclosed within this Proxy Statement pursuant to the compensation disclosure rules of the Exchange Act (Item 402 of RegulationS-K), which disclosure includes the Compensation Discussion and Analysis, summary executive compensation tables and related narrative information contained in this Proxy Statement.

|

The following table sets forth, as of April 8, 2020, the name and age of our executive officers and the positions and offices they currently hold:

|

|

| ||

|

|

| ||

|

|

| ||

|

|

| ||

|

|

| ||

|

|

| ||

|

|

| ||

|

|

| ||

|

|

| ||

|

|

| ||

Set forth below are descriptions of the backgrounds of each of our executive officers who are not directors, as of April 8, 2020:

Brian T. Nicholson has served as the Chief Financial Officer of the Corporation and ESH REIT since May 2018. Mr. Nicholson previously served as Chief Financial Officer of The Fresh Market, Inc. from September 2016 to May 2018, where he also served as Interim Chief Executive Officer from June 2017 to September 2017. From September 2015 to July 2016, Mr. Nicholson was the Executive Vice President and Chief Financial Officer of Driven Brands, Inc. From June 2012 to September 2015, Mr. Nicholson was the Vice President of Financial Planning & Analysis for the Corporation. He previously served in finance, strategy, and consulting roles for The Fresh Market, Inc. and ScottMadden, Inc.

Kevin A. Henryhas served as Executive Vice President and Chief Human Resources Officer of the Corporation since August 2014. From December 2010 to August 2014, Mr. Henry served as Senior Vice President and Chief Human Resources Officer ofSnyder’s-Lance, Inc., a national snack food company. From January 2010 to December 2010, he served as Chief Human Resources Officer of Lance, Inc. Prior to that, Mr. Henry served in a variety of positions at Coca-Cola Bottling Co. Consolidated, a beverage manufacturer and distributor, including as Chief Human Resources Officer from 2007 to 2010 and Senior Vice President of Human Resources from 2001 to 2007.

Christopher N. Dekle has served as General Counsel and Corporate Secretary of the Corporation and ESH REIT since June 2018. Mr. Dekle has previously served as Deputy General Counsel, Vice President and Assistant Secretary from October 2013 to June 2018. He previously served as General Counsel and Vice President from April 2010 to October 2013, as Assistant General Counsel from January 2007 to April 2010, and Corporate Counsel from July 2005 to December 2007 at HVM LLC. From 2003 to 2005, he was General Counsel for Employers Life Insurance Corporation. From 1997 to 2003, Mr. Dekle was in private practice.

|  |

Howard J. Weissmanhas served as Chief Accounting Officer of the Corporation and ESH REIT and Corporate Controller of ESH REIT since May 2015 and Corporate Controller of the Corporation since November 2013. He previously served as Corporate Controller at HVM LLC from December 2011 to November 2013. From May 2009 to December 2011, Mr. Weissman worked at Campus Crest Communities, Inc., serving as Senior Vice President and Corporate Controller. From July 2007 through May 2009, Mr. Weissman was Controller and Chief Accounting Officer of EOP Operating Limited Partnership, LP, the private company successor to Equity Office Properties Trust, a commercial office real estate company owned by The Blackstone Group. From May 2003 through May 2007, Mr. Weissman served in a variety of positions with CarrAmerica Realty Corporation, a commercial office real estate company, including as Assistant Controller, Vice President of Shared Services and Controller.

Randolph H. Fox has served as Executive Vice President, Property Operations of the Corporation since November 2019. He has more than 35 years of hotel business experience, including most recently as Chief Operating Officer of InTown Suites and Uptown Suites, an extended stay brand. He served as Executive Vice President of Operations for WoodSpring Hotels from 2012 to 2016. He earlier spent more than 12 years at Red Roof Inn, including as Senior Vice President of Operations from 2007 to 2012 and Regional Vice President of Operations from 1999 to 2007.

Kelly Poling has served as Executive Vice President, Chief Commercial Officer of the Corporation since January 2020. Ms. Poling was most recently Chief Executive Officer of Premier Worldwide Marketing, the exclusive worldwide representative for Karisma Hotels & Resorts, and previously served as Executive Vice President, Marketing and Consumer Revenue from 2017 to 2019. From 2014 to 2017, Ms. Poling served as Executive Vice President and Chief Marketing Officer for WoodSpring Hotels, and earlier in her career, spent seven years at Choice Hotels International, leading the corporate strategy, marketing ande-commerce teams.

Michael L. Kuenne has served as Senior Vice President – Chief Customer Experience Officer of the Corporation since February 2020. He oversees teams responsible for Quality Assurance, Guest Relations, & Brand Reputation, Brand Standards, Brand Programs, Training and Enterprise Procurement. Previously, Mr. Kuenne held multiple leadership positions in the Corporation’s Technology, Operations and Human Capital organizations. Prior to joining the Corporation, Mr. Kuenne held a leadership role in the Technology practice for The North Highland Company; a consultancy focused on Strategic Planning, Change Management and Operations efficiency. He also held multiple management positions with Wells Real Estate Funds, later listed as Piedmont Office Real Estate Trust, a diversified Class ‘A’ office REIT.

Nancy K. Templeton has served as Senior Vice President, Chief Information Officer of the Corporation since February 2020. Previously, Ms. Templeton held progressive leadership roles in the Corporation’s IT organization. Prior to joining the Corporation, Ms. Templeton spent 25 years at Belk, Inc., including in the role of Director of Merchandising Systems.

|

Compensation Discussion and Analysis

This CD&A explains our executive compensation program for our NEOs listed below. The CD&A also describes the process followed by the Compensation Committee for making pay decisions, as well as its rationale for specific decisions related to 2019 compensation.

| ||||

| ||||

|  | |||

|  | |||

|  |

| ||

2019 saw important achievements for the Company and our shareholders, with the Company returning approximately $300 million to our shareholders through dividends and share repurchases and growth in our franchise and development program. More information about these actions, our 2019 business achievements, and the resulting compensation actions taken by the Compensation Committee are summarized in the following narrative.

|  |

In 2019, our NEOs were:

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

|

|

2019Say-On-Pay and Shareholder Outreach

Each year, we carefully consider the results of our shareholdersay-on-pay vote from the preceding year. We also take into account the feedback we receive from our major shareholders. At our 2019 Annual Meeting of Shareholders, more than 96% of shares cast voted in favor of the advisory vote on executive compensation. We also view a continuing, constructive dialogue with our shareholders as crucially important to ensuring that we remain aligned with their interests. To this end, we speak to almost all of our top 25 shareholders at least annually, which represent approximately 60% of our outstanding shares. During 2019, our investor relations outreach extended to over 300 investor meetings and calls, which covered a broad range of topics including Company strategy and performance, governance and executive compensation. Overall, and consistent with oursay-on-pay results, our shareholders are supportive of our executive compensation program and its direction. We will continue to keep an open dialogue with our shareholders to help ensure that we have a regular pulse on investor perspectives.

2019 CEO Compensation and CEO Transition Information

Mr. Halkyard entered into a separation letter agreement with the Corporation, pursuant to which Mr. Halkyard resigned as President and Chief Executive Officer and as a director of the Corporation, effective as of November 21, 2019. Pursuant to the separation letter agreement, Mr. Halkyard provided assistance and advisory services to the new President and Chief Executive Officer of the Corporation as an employee of the Corporation from November 22, 2019 through February 25, 2020. Mr. Halkyard’s equity-based awards continued to vest in accordance with their terms through February 25, 2020, on which date Mr. Halkyard’s employment with the Corporation ended. Mr. Halkyard was eligible to vest through the end of December 31, 2019 in respect of his performance-based restricted stock units granted in 2017, and his performance-based restricted stock units granted in 2018 and 2019 were forfeited on November 21, 2019.

|

On November 21, 2019, the Board of Directors of the Corporation appointed Mr. Haase, who was serving at the time as a director of ESH REIT, as President and Chief Executive Officer of the Corporation and as a director of the Corporation, effective as of November 22, 2019. In connection with Mr. Haase’s appointment as President and Chief Executive Officer, the Corporation and ESH REIT and Mr. Haase entered into an offer letter, effective November 22, 2019, and he continues to serve as a director of ESH REIT. The offer letter provides that for the period commencing on November 22, 2019 through the end of December 31, 2021, Mr. Haase will be entitled to an annual base salary in cash at the rate of $100,000 per annum and receive a grant of restricted stock units in respect of 175,000 Paired Shares under the terms of the Amended and Restated Extended Stay Long Term Incentive Plan (“LTIP”). The restricted stock units (“RSUs”) will vest in respect of 7,000 Paired Shares on the last day of each calendar month beginning in December 2019 and ending in December 2021, subject to Mr. Haase’s continued employment on each vesting date. In the event that Mr. Haase’s employment is terminated by the Corporation without Cause (as defined in the LTIP) before the last day of the calendar month, then the 7,000 RSUs that would have vested in that calendar month will instead vest on a pro rata basis through Mr. Haase’s termination date. In addition, Mr. Haase will not participate in the annual bonus program in respect of 2019 service, nor in 2020 or 2021. Commencing in 2021, Mr. Haase will be eligible for equity-based grants pursuant to the LTIP in an amount determined by the Boards of Directors of the Corporation and ESH REIT or the Compensation Committees thereof. This compensation structure was designed by the Compensation Committee, with input from Mr. Haase, to emphasize performance-based compensationsatisfied, such that the value of Mr. Haase’s compensation package includingproposed mergers will not close or that the cash salaryclosing may be delayed; general economic conditions; the proposed mergers may involve unexpected costs, liabilities or delays; risks that the transaction disrupts current plans and grant date fair valueoperations of the Paired Share grant is approximately equalCompanies; the outcome of any legal proceedings related to the annual cash and annual bonus compensationproposed mergers; the occurrence of his predecessor, but because almost 98% of this value is inany event, change or other circumstances that could give rise to the form of Paired Shares, Mr. Haase will directly participate, in the same way as the Company’s shareholders, in any increase or decrease in the value of those Paired Shares. Both the Compensation Committee and Mr. Haase believe that this unique structure sets the appropriate tone and motivation for Mr. Haase during this initial phase of his tenure as the Company’s President and Chief Executive Officer. As described above, additional future incentives will be made available to Mr. Haase, generally beginning in 2021, based on the appropriate performance goals and strategic planstermination of the Company at that time. Mr. Haase participates in the standard package of employee benefits maintained by the Corporation’s subsidiary, ESA Management LLC (“ESA Management”) to provide employees, including the NEOs, with retirement savings opportunities, medical coveragemerger agreement. For more details on these and other reasonable welfare benefits.

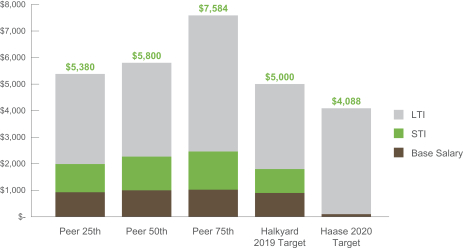

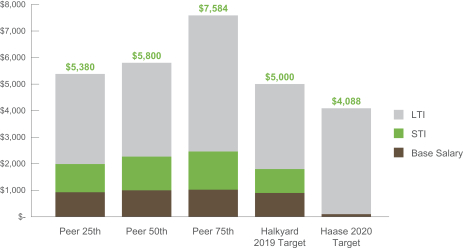

Mr. Haase’s target compensation as set forth above, when compared to our peer group (which we describe under the section entitled “The Role of Peer Groups”), is in the 25th percentile, with 98% of his compensation package being payable in equity. Furthermore, this is a significant shift in compensation as compared to Mr. Halkyard’s 2019 target compensation, which was comprised of a $900,000 base salary, a target annual bonus opportunity of 100% of his base salary,potential risks and grant date fair value of equity of approximately $3,200,000. Mr. Halkyard’s target direct compensation, as compareduncertainties, please refer to the target direct compensation for CEOs of our peer companies, was also injoined proxy statement when filed and the 25th percentile, but only 65% of his compensation package was payable in equity.

|  |

Each of Mr. Haase’s and Mr. Halkyard’s annualized compensation, as compared todocuments that the compensation for CEOs of our peer companies, was as follows (amounts shown in thousands):

|

Additional Executive Officer Transition Information

Mr. Alderman resigned from his position as Chief Asset Merchant of the Corporation and ESH REIT on March 2, 2020, effective as of March 13, 2020.

Mr. Flynn entered into a separation letter agreementCompanies file with the Corporation on January 30, 2020 as a result of his position of Executive Vice President, Shared Services being eliminated on January 31, 2020. During the period from February 1, 2020 through February 28, 2020, Mr. Flynn served as an advisor to the Corporation. Mr. Flynn continued to serve in his role through February 28, 2020 under the terms and conditions of hispre-existing arrangements and during the transition services period, Mr. Flynn continued to receive his base salary, was eligible to receive a target annual bonus for 2019, and he continued to vest in his outstanding equity-based awards through February 28, 2020. Following his execution andnon-revocation of a release of claims, Mr. Flynn is currently receiving the benefits provided under the Executive Severance Plan, which include cash severance, health plan benefit continuation and outplacement services.

|

Compensation Practices & Policies

We believe our compensation practices and policies promote sound compensation governance and are in the best interests of our shareholders and executives:

| ||||||

|

|

|

| |||

|

|

|

| |||

|

|

|

| |||

|

|

|

| |||

|

|

|

| |||

|

|

|

| |||

|

|

|

| |||

|

| |||||

Executive Compensation Program Guidelines

The philosophy underlying our executive compensation program is to employ the best leaders in our industry to ensure we execute on our business goals, promote bothshort-and long-term profitable growth of the Corporation, and create long-term shareholder value. To this end, other than for our President and Chief Executive Officer whose compensation is substantially tied to the long-term value of the Company’s common stock (please see “2019 CEO Compensation and CEO Transition Information” for a discussion on the President and Chief Executive Officer’s compensation package), our program is grounded by the following guiding principles:

|

| |

|

| |

|

| |

|  |

Our compensation philosophy is supported by the following principal compensation elements:

|

| |

|

| |

|

| |

|

| |

The Role of the Compensation Committee

The Compensation Committee oversees the executive compensation program for our NEOs. The Committee consists entirely of independentnon-employee members of the Board. The Committee works closely with its independent consultant and management to examine the effectiveness of the Company’s executive compensation program throughout the year. Details of the Committee’s authority and responsibilities are specified in the Committee’s charter, which may be accessed at the investor relations section of our website at www.aboutstay.com.

The Committee makes all final compensation and equity award decisions regarding our NEOs. The Committee, together with management, also reviews our compensation practices and policies with regard to risk management and has determined that there are no policies or practices that are likely to lead to excessive risk-taking or have a material adverse effect on the Corporation.

WhileSEC. All forward-looking statements speak only Committee members make decisions regarding executive compensation, at the request of the Committee, members of our senior management team typically attend meetings during which executive compensation, company and individual performance, and competitive compensation levels and practices are discussed and evaluated. The Committee also receives recommendations from the CEO regarding the compensation of our other executive officers, including the other NEOs. The CEO does not participate in the deliberations of the Committee regarding his own compensation.

|

The Role of the Independent Consultant

Pursuant to authority granted to it under its charter, the Committee engages Pearl Meyer as its independent compensation consultant to provide expertise on competitive pay practices, program design, and an objective assessment of any inherent risks of any programs. Pearl Meyer reports directly to the Committee and does not provide any additional services to management. The Committee has conducted an independence assessment of Pearl Meyer in accordance with SEC rules and has determined that work performed by Pearl Meyer does not create a conflict of interest.

As part of our compensation philosophy, our executive compensation program is designed to attract, motivate and retain our NEOs in an increasingly competitive and complex talent market. As such, the Committee evaluates industry-specific and general market compensation practices and trends to ensure that our program remains appropriately competitive.

For all of the NEOs, cash compensation amounts have been set to provide a certain degree of financial security at levels that are believed to be competitive for similar positions in the marketplace in which we compete for management talent. In addition, the annual incentive program has been designed to meaningfully reward strong annual Company performance in order to motivate participants to strive for the Company’s continued growth and profitability. In 2019, the compensation program continued to support the Corporation’s and ESH REIT’s long-range business goals and growth strategies.

The Committee periodically considers publicly-available data for informational purposes when making its compensation-related decisions. However, market data is not the sole determinant of the Corporation’s practices or executive compensation levels. When determining base salaries and incentive opportunities for the NEOs, the Committee also considers the performance of the Corporation and the individual, the nature of an individual’s role within the Corporation, as well as experience and contributions in his or her current role.

Each year, with the support of Pearl Meyer, the Committee reviews the previous year’s peer group to ensure it remains valid for benchmarking purposes and makes adjustments as necessary to reflect changes in business strategy and circumstances (e.g. acquisitions or mergers).

|  |

For purposes of setting compensation in 2018 for the 2019 calendar year, the Committee, based on recommendations from Pearl Meyer, approved the following Compensation Peer Group, which includes the eighteenc-corp peer companies and eleven REIT peer companies listed below.

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| ||

| ||

| ||

| ||

| ||

| ||

| ||

|

|

2019 Executive Compensation Program in Detail

Base salary is considered together with the annual cash incentive opportunity as part of a cash compensation package. Generally, the Corporation believes that the base salary level should be aligned with the NEO’s position, duties and experience, be reasonable relative to the other NEOs’ base salaries and be set at a level that is competitive as compared to salaries for similar positions within companies or markets from which we recruit talent.

|

The Compensation Committee reviews the compensation of each of the NEOs each year, including base salary, and makes changes based on performance and a review of market compensation.

NEO

| Salary Through May 4, 2019

| Salary Adjustment %

| Salary Adjustment $

| Salary Effective

| ||||||||||||

Bruce N. Haase(1)

|

| N/A

|

|

| N/A

|

|

| N/A

|

|

| N/A

|

| ||||

Kevin A. Henry

| $

| 460,000

|

|

| 3.00%

|

| $

| 13,800

|

| $

| 473,800

|

| ||||

Brian T. Nicholson

| $

| 460,000

|

|

| 2.25%

|

| $

| 10,350

|

| $

| 470,350

|

| ||||

James G. Alderman Jr.

| $

| 430,000

|

|

| 3.00%

|

| $

| 12,900

|

| $

| 442,900

|

| ||||

Ames B. Flynn

| $

| 424,000

|

|

| 3.00%

|

| $

| 12,720

|

| $

| 436,720

|

| ||||

Jonathan S. Halkyard

| $

| 900,000

|

|

| 3.00%

|

| $

| 27,000

|

| $

| 927,000

|

| ||||

|

Pursuant to the terms of Mr. Haase’s offer letter, effective as of November 22, 2019, his base compensation consists of cash in the amount of $100,000 per annum and a grant of 175,000 restricted stock units, which vest in respect of 7,000 Paired Shares on the last day of each calendar month beginning in December 2019 and ending in December 2021.The determination to grant to Mr. Haase equity-based payments as part of his base compensation was structured to tie his pay to the performance of the Company’s stock over time. The Company’s determination of the number of restricted stock units granted to Mr. Haase was based on the value of the per share price of the Company’s stock on or about the date that Mr. Haase was appointed as the Chief Executive Officer and President. The total value of his cash-based and equity-based base compensation payments is intended to equal the approximate value of Mr. Halkyard’s 2019 base salary amount.

|  |

The 2019 Annual Incentive Program provided our NEOs the opportunity to earn a performance-based annual cash bonus. Actual award payouts depend on the achievement ofpre-established performance objectives and can range from 0% to 200% of target award amounts. For 2019, each of Messrs. Halkyard, Nicholson, Henry, Flynn and Alderman was eligible to earn a target annual award equal to 100% of his annual base salary. Under the terms of his offer letter, Mr. Haase was not eligible to earn an annual award or an annual cash bonus for the 2019 performance period. The Committee also considered market data in setting the following threshold, target and maximum award opportunities for 2019:

Annual Incentive Opportunity

| ||||||||||||||||

NEO

| Base Salary

| Threshold

| Target

| Maximum (200% of Target)

| ||||||||||||

Bruce N. Haase

| $

| 100,000

| (1)

|

| N/A

|

|

| N/A

|

|

| N/A

|

| ||||

Kevin A. Henry

| $

| 473,800

|

| $

| 236,900

|

| $

| 473,800

|

| $

| 947,600

|

| ||||

Brian T. Nicholson

| $

| 470,350

|

| $

| 235,175

|

| $

| 470,350

|

| $

| 940,700

|

| ||||

James G. Alderman Jr.

| $

| 442,900

|

| $

| 221,450

|

| $

| 442,900

|

| $

| 885,800

|

| ||||

Ames B. Flynn

| $

| 436,720

|

| $

| 218,360

|

| $

| 436,720

|

| $

| 873,440

|

| ||||

Jonathan S. Halkyard(2)

| $

| 927,000

|

| $

| 463,500

|

| $

| 927,000

|

| $

| 1,854,000

|

| ||||

|

|

The CEO’s direct reports are eligible to earn bonuses in the range of 0% to 200% of their individual annual bonus target based on (1) the achievement of the Company’s 2019 Adjusted EBITDA goal and (2) the executive’s individual performance contributions toward the achievement of the Company’s 2019 Adjusted EBITDA goal. The Company must achieve the threshold Adjusted EBITDA for any annual cash incentive award to be paid.

The achievement of the Company’s 2019 Adjusted EBITDA goal represents 80% of the individual annual incentive award.

Individual performance, which represents 20% of the individual annual incentive award, was determined based on the executive’s individual performance as evaluated by the CEO and reviewed and approved by the Compensation Committee. The outcome of this assessment could have earned the executive from 0% to 200% of this portion of the executive’s annual bonus.

Adjusted EBITDA provides a useful measure of the Company’s financial performance and the ongoing operations of its business, since the adjustments exclude certain expenses that are not indicative of ongoing core operating results. Consistent with the Compensation Committee’s philosophy to set target

|

payout levels such that the relative difficulty of achieving the goal is anticipated to be generally consistent from year to year, for 2019, the target Adjusted EBITDA performance level represented a 2.2% decrease over thepre-adjustment 2018 performance levels. Further, the target Adjusted EBITDA performance level reflects (when set) the expectations of the general economic and industry factors for the coming year and the results of management’s initiatives to improve the performance of the Company.

The following table summarizes the threshold, target and maximum Adjusted EBITDA goals, as well as actual results for fiscal 2019. Straight-line interpolation is applied for performance above threshold. For purposes of the annual incentive awards, “EBITDA” refers to Adjusted EBITDA of the Company, as defined in our combined annual report on Form10-K for the year ended December 31, 2019.

Performance Measure | Threshold | Target | Maximum | Actual | ||||||||||||

Adjusted EBITDA (in millions) | $ | 550 | $ | 586 | $ | 610 | $ | 535.1 | ||||||||

Based on the above results and other adjustments, the Compensation Committee determined that the Company’s actual Adjusted EBITDA for purposes of determining achievement under the plan was $535.1 million, and therefore the threshold level of performance for this measure was not achieved and no awards were paid under this plan.

Given the efforts of certain executives throughout the year, their continued dedicated performance during the significant leadership transition during 2019, and their focus on creating long-term shareholder creation, in February 2020, the Compensation Committee approved special bonuses for certain of the executive officers, with values ranging from $265,740 to $284,280. Half (50%) of these bonuses were paid in cash and half (50%) of these bonuses were paid in time-based restricted stock, which will vest one year from the date of the grant, subject to continued employment on the vesting date. Under this arrangement, Messrs. Nicholson, Henry, and Alderman earned cash bonuses of $141,090, $142,140, and $132,870, respectively. Neither Mr. Halkyard nor Mr. Haase was eligible to receive a 2019 cash bonus under the terms of his separation letter agreement or offer letter agreement, respectively. Mr. Flynn did not receive an award under this arrangement. The 2019 discretionary bonuses were paid in February 2020 and the corresponding restricted stock units grants were also awarded in February 2020 based on the same value as the cash award.

|  |